Table of Content

When you receive a lump sum of cash from a cash-out refi, it is added back onto the balance of your new mortgage, usually causing your monthly payment to increase. A home equity loan is different -- it does not replace your existing mortgage and instead adds an additional monthly payment to your expenses. The one-time charge of $149 that applies to newly booked home equity loans due at closing is waived, except appraisal costs or title insurance, if required. Member is responsible for appraisal costs ranging from $400-$600, if required. Refinancing of existing UW Credit Union home equity loans does not qualify for the closing costs offer.

Unauthorized account access or use is not permitted and may constitute a crime punishable by law. Please view ourPrivacy Policy,Email Opt Out Procedureand Fraud Alert Text/SMS Notification Terms and Conditions. This credit union is federally insured by the National Credit Union Administration.

How to Calculate Your Home Equity

Reimbursement fee of up to $250 if loan is reconveyed within 24 months. Convert that number to a percentage by moving the decimal point two places to the right. Create a Budget and Save Money — During a financial counseling session, members will create a spending plan that works towards their financial goals, including building savings.

Your best bet for improving your LTV is to pay down your mortgage balance as quickly as you can. Another option is to dive into some home improvements that will bump up your home’s value. You can borrow against your house, even as a brand-new homeowner. With lenders willing to provide up to 100% LTV home equity loans, you can access significant financing even if the ink on your closing documents is barely dry. Suppose that your home is worth $150,000, and your mortgage balance is $100,000. A 100 LTV home equity loan would give you $50,000 in cash.

We Have You Covered With Home Equity Loans Up to 100% of Your Home’s Value*

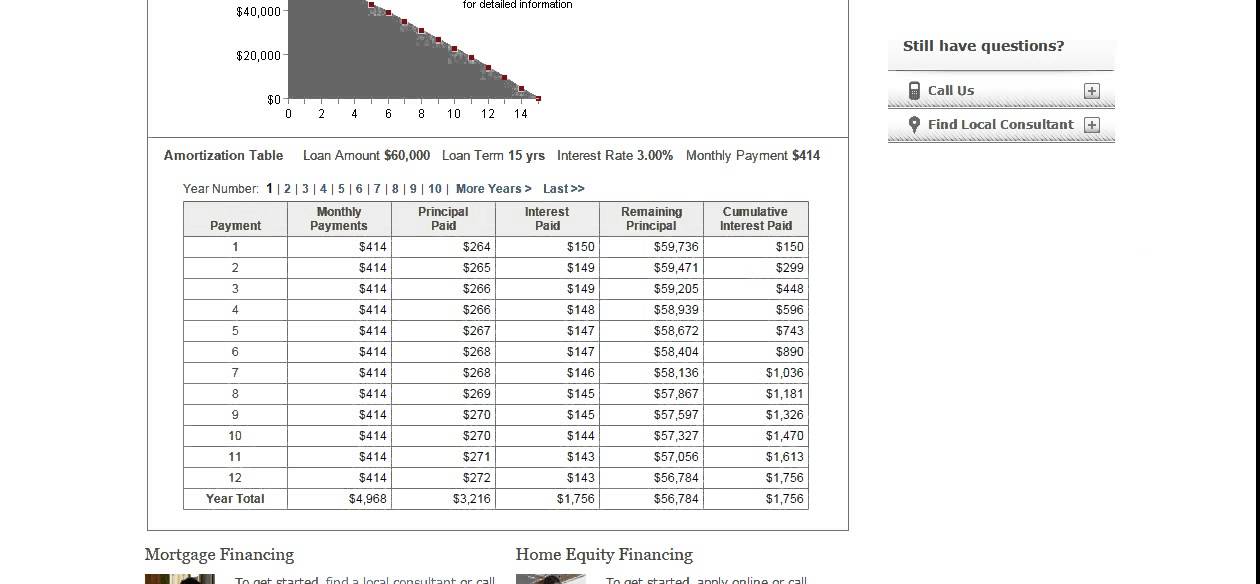

AmeriChoice recently started offering home equity loans for 100% loan-to-value. Typically, home equity loans are only taken out against a certain percentage of available equity, meaning that there is still some equity available, but not being used. But, with the 100% loan-to-value, you’re able to access all of the available equity in your home, which gives you access to more funds, should you need them. A home equity loan calculator is a good way to start exploring price options for tapping the equity in your home.

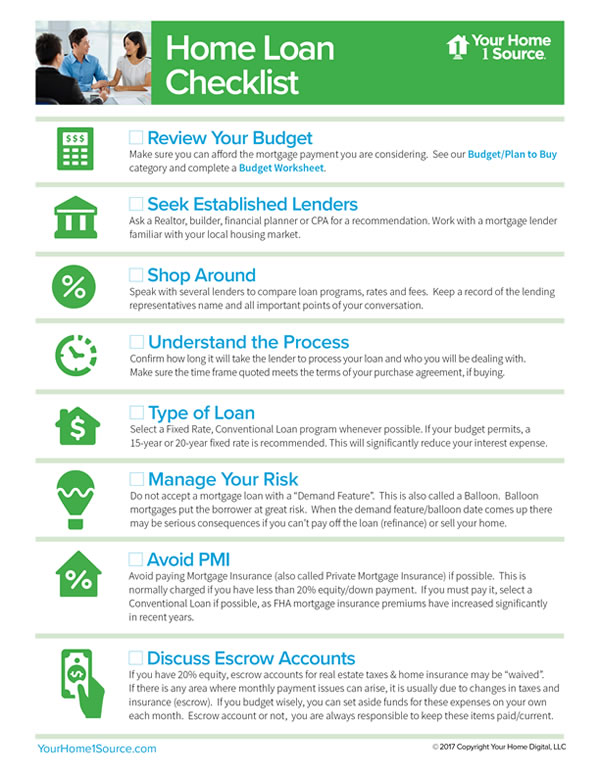

Both are in the Federal Deposit Insurance Corporation’s database of banks. Home equity loans are a type of loan that uses your home as collateral and allows you to borrow against that equity. While 80% is often used as a rule of thumb when it comes to LTVs, different loan types may have different rules when it comes to LTVs. That said, aiming for as low an LTV as possible can help ensure that you’re getting the most competitive loan rates. Andrea Riquier is a New York-based writer covering mortgages and the housing market for Forbes Advisor.

Next Up in Home Equity

Here are some ways to lower your LTV if you’re already a homeowner. Getting the lowest sale price possible can positively affect your LTV, especially if you purchase a home below its perceived value and therefore, take out a lower mortgage amount. Purchasing a home above its sale price requiring a larger mortgage may mean that your LTV may start at a higher ratio than it would have if the buyer had accepted a lower bid.

Your loan-to-value ratio is a percentage that indicates how much equity you have in your home. LTV is used to help determine rates for home equity loans and lines of credit. A GOOD CREDIT SCORE At a minimum, you’ll likely need a 620 credit score to get a home equity loan. But, to access lower interest rates, you’ll want a score of 740 or higher.

Not only can home improvements potentially boost your home’s value, but they can also provide tax benefits. Generally speaking, IRS rules allow you to deduct the interest paid on mortgages used to “buy, build or improve” a home, including home equity loans, worth up to $750,000. You could use some of your equity as a down payment to purchase an investment property, which could be used to host Airbnb guests or rent to long-term tenants, building a passive income stream. FINANCIAL DOCUMENTATION Lenders will check your assets, employment history and income to determine whether you can repay a home equity loan on top of your first mortgage and other monthly obligations.

In other cases, the bank may require that you get a formal appraisal. A professional appraiser will need to visit your home and offer a formal report with an estimate of how much it is worth. In most cases, you'll have to pay a few hundred dollars to the appraiser. Keep this in mind as part of your budget when applying for the loan. Before you can get a home equity loan or home equity line of credit, the lender must know how much your home is actually worth. In some cases, a bank may simply look at the value of the home in internet databases or specialized resources, looking at nearby homes of similar shape and size and how much they sold for.

The rates shown above are for loans from $50,000 to $99,999 for a borrower with a credit score of at least 730 and up to 70% loan-to-value ratio. To get the lowest rate, the bank also requires customers to make automatic payments from a U.S. U.S. Bank’s starting APR is lower than the national average. The bank also allows you to get a “loan estimate” in real time, which would include the estimated interest rate, monthly payment and total closing costs. Other details—such as the minimum credit score required and average time to close a loan—are not readily available, and the bank did not respond to requests for information.

The linked site contains information that has been created, published, maintained, or otherwise posted by institutions or organizations independent of this organization. We do not endorse, approve, certify, or control any linked websites, their sponsors, or any of their policies, activities, products, or services. We do not assume responsibility for the accuracy, completeness, or timeliness of the information contained therein. Visitors to any linked websites should not use or rely on the information contained therein until they have consulted with an independent financial professional.

Here’s another reason to put as much as possible toward a down payment. Not only will a 20% down payment allow you to avoid private mortgage insurance, it will also ensure that you start your home ownership journey with a 80% LTV. This may allow you to increase your chances for earning approval for a home equity loan in the future.

This is available with zero origination fees, zero application fees, zero appraisal fees, and low, fixed rates. Fifth Third Bank offers among the most customer-friendly home equity loans with the ability to tap more of your home’s equity and a lower credit score requirement than most competitors. As of September 27, the lender had a starting rate of 6.74% for a good-quality borrower, according to a bank representative. This places Fifth Third’s rates in the middle of its peers. The starting APR is for a five-year loan term and up to 70% CLTV. Depending on the loan term, you can borrow as little as $10,000 and as much as $500,000.

Results are based on an 80% loan-to-value ratio, but you can always borrow less. That’s the percentage of the current market value of the property you wish to finance. You may want to check your credit score or look at your full credit report from the major credit reporting companies before you apply for a loan. You can obtain a free credit report from each major credit bureau once per year, and various websites can estimate your credit score either for free or for a fee. If you see anything erroneous on your credit report, you can work with the credit reporting agency to get it fixed before you apply for the loan.

AmeriChoice lets you put your equity to work for you with great rates available today. A home equity loan or HELOC can provide extra income to fill in the gaps. You’ll have the flexibility to use your loan proceeds for virtually any purpose. The challenge is deciding whether it’s worth losing most or all of your available home equity to achieve your intended financial goal.

No comments:

Post a Comment